|

By Amanda Weathersby, Partner, The Profitable Idea LLC

A pair of Osprey live above my house in a large nest made of sticks nestled into branches of a sweetgum tree. As I’m writing this, they are talking loudly about reinforcing the nest, being hungry, or about frightening off predatory birds (including other Osprey) who want to take over their ideal spot. Reminds me of more than a few business meetings. That got me thinking. Ospreys, unlike most small businesses, typically live for about 10 years. Their life cycle is a struggle. Every year, they migrate about 4,200 miles to South America in the winter, then back again to their birthplace in the US or Canada from March through November. One of them has to protect their biggest asset, the nest, while the other has to hunt enough fish to feed both parents and any chicks. One study says that diving Osprey catch a fish 8 out of 10 times they try for one. That’s important because each adult Osprey eats several large fish per day. Small business owners struggle, too. They have to build a business out of thin air. That takes imagination, money, acquiring new skills, wearing many hats, endless time, lots of energy, and the ability to solve problem after problem, after problem. Stamina is important – like flying 4,200 miles twice a year. Once the business is built, owners need to protect their asset. A new restaurant opens, and a leaky pipe creates water damage to the freshly painted wall. The computer that survived the startup won’t make it through to break even. The first employee quits. Time to reinforce the nest, which costs money that wasn’t in the budget. Many businesses start without any forecast of how many prospects they will need to make each sale and the revenue required to sustain their business. Fortunately, like the Osprey’s success with catching fish, there are studies showing how many prospects it takes. And it’s more than you think. On average, not even 1 prospect out of 10 buys from the small business. And remember, you have to feed the business, plus the business owner, employees, and don’t forget the families! Osprey almost went extinct, but DDT, the pesticide causing their birth rates and likelihood of survival to plummet, was outlawed in the US and Canada in 1972. Since then, they have made a remarkable comeback! Recessions and pandemics cause small businesses to perish at high rates. But like the Osprey, they can make a comeback, with the right tools and support to understand out how to build their businesses with the best chances of sustainability.

0 Comments

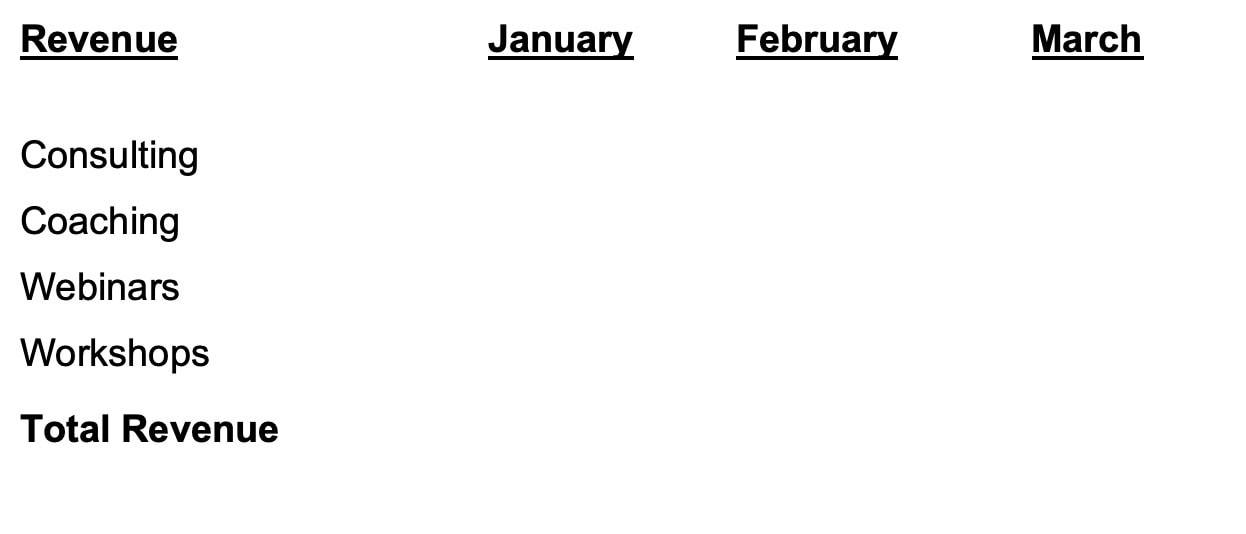

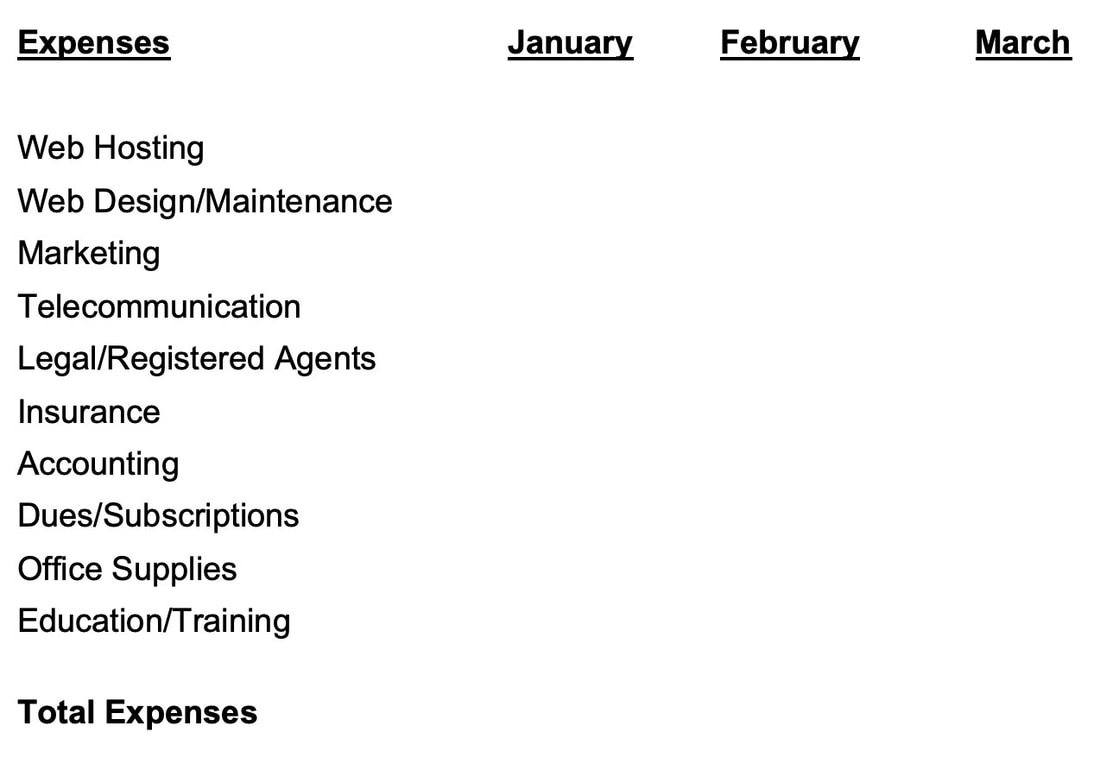

By Cindy Flanders, Partner, The Profitable Idea LLC What do small business owners search for more than anything? Information on a Profit and Loss statement. Do I need one? What is the purpose? How often do I need to update it? Why not just balance my check book? How do I create one? The Profit and Loss mystery may be why so many smaller and newer business owners make so little profit and little, if any, income. As a former banker, the one thing I always emphasize with the small business owners we work with is, “accounting is a must have in your business.” And yet many small business owners, especially solopreneurs, view creating and maintaining a Profit & Loss statement right up there with root canals. But it doesn’t have to overwhelm you. Just remember to keep it simple. For small business owners who are providing a basic service, such as consulting, workshops, coaching, and webinars, it’s easy to set up a Profit & Loss statement in either Google Sheets or Microsoft Excel Online. Start with listing all your revenue source categories and a column for each month. For Example: Then list all your expenses. For example: Even if you have never used Excel, setting up basic accounts in either of these programs is very simple. Here’s the key. It’s important to update the sheet monthly and not wait until the end of the year.

If you are selling a product and have inventory or equipment, such as food items, art pieces, books, or car parts, then purchasing a basic accounting software package like Quickbooks will be the most cost-effective way to keep track of your monthly net profit. Once you set up the Profit and Loss Statement in Quickbooks, remember, you have to update the sheet monthly! If after trying these online programs or software packages you’re still having trouble, then look for a local accountant or small accounting firm that offers bookkeeping services. You’ll pay more but will know how much profit you’re making or not making and can adjust the business quickly by cutting expenses, super-charging sales and marketing activities, or increasing pricing. This may seem very basic, but you’d be surprised at how many small business owners think they are managing their business by balancing their checkbook every month. Additionally, if you ever want to get a traditional bank loan, you will need to show them Profit & Loss statements for at least 2 to 3 years. So why not sink your teeth into it and help boost your profitability and income in the long run? All the best, Cindy Flanders 'By Amanda Weathersby, Partner, The Profitable Idea

Today small business owners are all powerful! For their companies they can create videos and post them around the world, self-publish an e-book, design ads, set up websites, fashion an invoice and payment processing system online, develop personalize training programs, establish a payroll processing structure, produce a revenue and expense tracking system to make reporting and taxes easier, devise a prospect and customer communications system to stay in front of their market, recruit and hire new staff online, and so much more! And the business owner can do all that in their free time. After they brew beer, bake bread, provide customers with IT services, redesign client’s websites, or grow specialty produce. None of us wants to lose the ability to 'do it yourself' to save money. But we need to remember that doing so much of it ourselves takes up more than half our time, time we cannot spend creating and selling our products or providing our billable services to clients. Ultimately one of the causes of so many small businesses not being profitable and a third of business owners not earning an income is overdoing ‘do it yourself.' Are there strategies to reduce the amount of time we must spend on automation that supports running a business so we can spend more time on the business itself? Yes!

All the best! Amanda By Cindy Flanders, Partner, The Profitable Idea LLC

Before we think about starting a business with the current gloom and doom of most economists, let’s fully understand what a recession is: “ 2 consecutive quarters of negative growth in the gross domestic product (GDP)” Deciding if we have a “soft” or “hard” landing is a topic for another day. For now, let’s focus on what types of businesses may actually do well in a recession. Think need to have vs. want to have. Unless of course, the want to have is a vice, since cigarettes and alcohol actually fare pretty well when the economy isn’t. Thinking of opening a brewery? Now might be a good time. So other than vices, what do most people need, no matter what? Childcare: You might be thinking that with so much remote work, the need for childcare has gone down. But having coached many people with children at home, I see it’s impossible to work without child care. They either have someone come into their home or drop them at daycare. It’s a need that will likely never go away. Repair Services: When you can no longer afford that new car or appliance, what will you do? Auto repair shops thrive in a recession. Before buying that new $3,000 refrigerator, you’ll probably see if it can be repaired. Grocery/Food stores: Is there any greater need than food? You may find yourself shopping more at discount stores like Walmart or Aldi, but you still gotta eat! And most people still pick up prepared food or dine out because of their busy schedules. Affordable eating concepts are still needed to fill in for those lost in the pandemic. Accounting/tax services: Last time I checked, the IRS did not give us a pass on paying our taxes in the last recession. So don’t look for any leeway in this next one. In fact, spending some extra money to determine if you can take advantage of tax credits may be well worth it. Healthcare services/providers: Sadly, your body does not know there’s a recession. There will always be a need for healthcare. In fact, home health care is expected to grow at 21% over the next decade. So if you’re thinking of starting a growth business in a recession and you have the expertise, this might be just the thing. There are many other businesses that can thrive in bad economic times. If you’re in doubt as to what you might want to start, just think- what do people need, no matter what? And contact us for a list of recession-proof industries for your business ideas. Email: contact@theprofitableidea.com Website: theprofitableidea.com By Cindy Flanders

Between me and my partner, Amanda Weatherby, we have started six businesses. Some of them have done extremely well, i.e., sold to a public company, and some have failed. We've also coached well over 100 entrepreneurs. So it’s with some experience, I outline key lessons we’ve learned along the way. 1. Start simple. Many entrepreneurs are full of ideas. In fact, it’s hard for them to pick just one and so they run the risk of overcommitting in time, money, and resources. It’s best to start with one idea and if that works, then grow or diversify. 2. Play to your strengths. Many businesses start as a partnership. I know mine have. There are several risks of having a 50/50 ownership. Who is really in charge? Who will make the final, tough decisions? Decide early on what strengths each partner brings to the business and stick to it. For us, Amanda is the marketing expert and so I defer all those decisions to her. I have more of a finance background, so the money issues fall to me. Keep each other informed, but stick to your knitting to avoid potential conflicts. 3. Do your research. Not only with our own businesses, but with many of the entrepreneurs we’ve worked with, owners are at a loss to outline the market size, the competition, total cost of producing their product, etc. This is basic information that should be included in a business plan and yet, it’s often overlooked in the excitement of launching an idea. 4. Know your financing options. For most small business owners or solopreneurs, bank financing is not going to be an option. So, before you start spending, create a budget that will include all your startup costs and at least 12 months of expenses. Do you have your own money to finance these expenses? If not, do you have friends and family that can help? What non-bank financing options are available to you? This is information you need BEFORE you sell your first service or launch your first product. 5. Have fun! Remember why you decided to go it alone. When you’ve put in a 12-hour day and still have household responsibilities to take care of, make sure you find some joy in what you’re doing. Finally, if your first business idea doesn’t pan out, take heart that you’re not alone. Even Bill Gates had at least one failed business before succeeding with Microsoft. There was a 24% leap in new business licenses filed in 2020 vs. 2019, or 4.3 million new businesses created during the first year of the pandemic. The surge in new compaines is continuing in 2021. So, what do all those 4.3 million plus new businesses need? Well, lots of things, but one thing most of them need is an organized, reliable, accurate, friendly, and resourceful person to assist them virtually so the founders can work on growing their businesses.

|

AuthorsAmanda Weathersby, and Cynthia Flanders are Co-Leaders for the Profitable Idea LLC, which is now online! Archives

May 2023

© Copyright The Profitable Idea, 2023

“The workshop provided me with insight that I have never heard before. I appreciate all the help, kindness, and willingness to guide me through the realistic view of my firm’s financial outlook. I will use the provided tools over and over.” G.B., Technology Business Owner |